Frugal living is a way of life for many people who take their finances seriously. If you would like to become more financially stable without continually stressing over bills, living a frugal lifestyle is one change you can make to save now and for the future.

While it may be a bit of adjustment for you, especially if you were living beyond your means for many years, it is a change that will benefit you in many ways.

You can do many things to start living a frugal lifestyle, saving money, and becoming financially secure, regardless of how much you currently earn.

Prioritizing Your Purchases

Frugal living means prioritizing your purchases. Some purchases are must-haves and are simply unavoidable. For example, you need to purchase groceries to have food for your family. You will need to pay for gas to put in your car when you need to get to and from work.

While these expenses are unavoidable, there are other purchases that you can avoid making. For example, you do not necessarily need to go out and buy the most expensive clothes or shoes.

You can purchase affordable clothing or pre-loved items that are much less expensive. Always prioritize your purchases if you want to start saving money.

Not Spending Money on Unnecessary Expenses

While prioritizing your purchases is one thing you should do, another thing you need to do to live a frugal lifestyle is avoiding spending money on unnecessary expenses. You may want to cut the cable, especially if you are not watching it that much.

- The cable cost is exceptionally high and can leave you struggling to pay other more essential bills, such as your phone bill, gas bill, and electricity bill. Instead of spending money on fast food, you can eat the food that you have at home.

~ How to Save on Your Heating Bill - It is much cheaper to purchase a week’s worth of groceries than it is to purchase fast food a few times per week. You could end up spending $20-$30 per day on fast food, which quickly adds up in a week.

~20 Frugal Food and Grocery Store Tips - When you look back at the amount of money spent in a month on fast food, you may be surprised to see that you have spent hundreds of dollars on unhealthy food when you could have put that money into a savings account.

Of course, this does not mean that you cannot treat yourself. You do have a right to treat yourself from time to time, but you should not overdo it because excessive spending will catch up to you and cause a financial burden in your life.

Setting a Budget to Follow

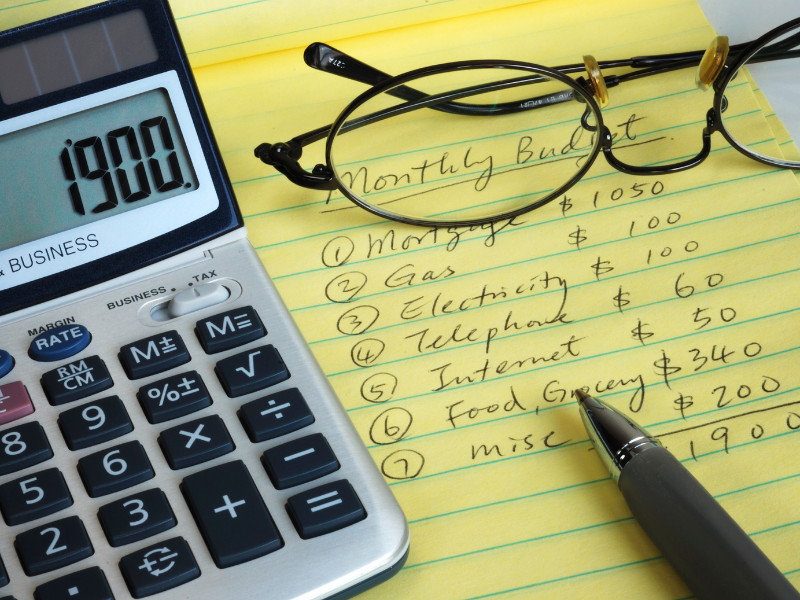

Living a frugal lifestyle means setting a budget that you can follow. Not all family budgets are the same. Before setting a specific amount that you have available to spend each month, you should sit down and review your finances.

- You need to see how much you are bringing in each month and how much you need to spend on necessities, including bills, groceries, gas, and other vital expenses.

- Once you have calculated those details, you will see how much you are left with and determine how much you will spend on other non-necessities per month.

Sticking to a tight budget means having more money to add to your savings account. As you start to see the money adding up in your savings account, you should begin to feel even more motivated to stick with the budget that you have set.

You will feel that sense of accomplishment for saving money that you can use for emergencies.

Building a Savings Account

Building a savings account is essential. You need to have something to fall back on if things go wrong. If you start adding a little bit of money to your savings account each week, you will end up with thousands of dollars saved by the end of the year.

Those who live frugally tend to have more money available to set aside into their savings accounts, which is convenient for many reasons.

Not only does having a savings account come in handy for emergencies, but it is also good to have as a cushion. You may feel more financially stable when you know that you have thousands of dollars in an account to use as a backup if you need it for something important.

Living Within Your Means Instead of Beyond Your Means

When living frugally, you are living within your means instead of beyond them. Sure, you might have a few credit cards with high credit limits. Though I recommend having no credit card debt.

Having credit does not mean that you should go on a shopping spree. If you live beyond your means by maxing out credit cards, you will find yourself dealing with a lot of debt.

The Importance of Being Debt Free and How to Do It

Having an excessive amount of debt can lead to stress and put a financial strain on you and your family. While it feels good to have nice things, it does not feel good to know that you owe thousands of dollars to different creditors.

If you live within your means instead of beyond your means, you will feel a lot better in the long run.

Using Coupons as Much as Possible

Do not underestimate the power of couponing. If you want to live frugally, you should use coupons as much as you possibly can. Use digital coupons and paper coupons that come in the newspaper and weekly circulars.

You can end up saving big on some of your favorite brands of food, beauty products, and toiletries. If you use coupons, you can save hundreds of dollars on items you need and want to have each month. There is no shame in using them!

Can You Live a Frugal Life?

Frugal living requires you to make wise decisions that will help you build a savings account and save more money instead of spending more than you can afford.

If you would like to live frugally, follow some of these helpful tips. You can eliminate unnecessary expenses, set a budget for yourself, and even start using coupons when shopping.

If you make these changes, you will eventually see a noticeable change taking place while you become more financially secure than before.